As if to prove the wisdom in the phrase “this isn’t over yet,” e-commerce retailers are about to face two massive problems at once: an unheard of amount of deadstock, and a major supply chain disruption (two of them, actually).

Emergency #1: Warehouses Packed With Deadstock

With global lockdowns still far from over and a financial collapse on the horizon, the fashion industry is stuck with warehouses full of Spring clothing they can’t sell, e.g. “deadstock.”

Many retailers are overstocked, and are cancelling and reducing their purchasing orders. This, in turn, has affected the brands, who are now overstocked as well. The usual tactic of selling the excess stock to an off-brand discounter like T.J. Maxx is currently off the table (the brick and mortar discounter is still on lockdown, and already has more clothing than they need).

Retailers depend on selling around 60% of their stock at full price, so a warehouse full of outdated product that will need to be discounted to move is a problem. A big one. And of course, it’s not just fashion that’s in trouble; the demand for other products has also shifted from original predictions, and many are quickly becoming obsolete.

Production losses are only part of the expense: the storage fees and opportunity costs continue to add up.

Emergency #2: Supply Chain Disruptions: Now & Soon

While supply chain lengths vary, an end-to-end estimate of 100-110 days serves as a typical timeline. Which means there are orders that started before we even knew what COVID-19 was, that still have not been completed.

And as we mentioned in the deadstock section, there is no space for these yet-to-arrive-items. If you’re having no luck unloading your deadstock through brick-and-mortar stores, it’s time to double down on e-commerce. There are a lot of new eyeballs on Facebook right now; if your deadstock isn’t moving with your usual customers, try promoting it to these new potential customers.

Another idea is to get creative and reframe your campaigns for the situation. Retailers like Nordstrom’s are facing the situation head-on with their range of work-from-home apparel.

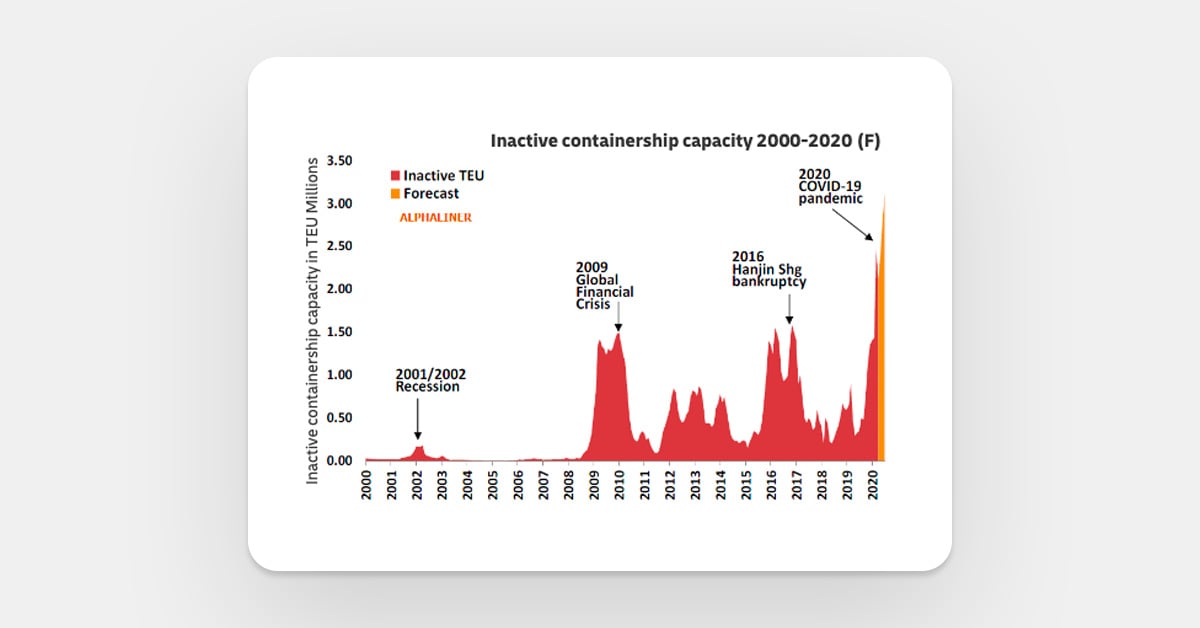

Unfortunately, excess deadstock is only the first part of the issue. The opposite problem happens next: a massive drop in shipping supply for the next quarter. How can we tell? Look at the shipping containers. As Q1 ended, we could see a massive spike in empty containers aboard shipping lines:

Source: DHL Market Update 2020

The year-over-year difference between 2019 and 2020 is staggering, and it has prompted a strong response from shipping companies.

As we head into Q2, several high-capacity strings (series of ports on a shipping route) will be removed from service completely, and global shipping capacity in general will see a nearly universal reduction. The worst affected routes can expect a capacity reduction of up to 30%. This situation is particularly grim for electronics retailers, who will face a shortage of semiconductors, and for any retailer practicing Just-in-Time (JIT) inventory management.

Even if retailers manage to clear their warehouses for Q2, there may not be enough supply available to restock them.

What Does This Mean For E-Commerce Retail?

Immediate Fixes

More than ever before, retailers need to focus on capital efficiency and overall profitability to make it through the next few months. This is a time for survival. By analyzing product data to find the most profitable items, then focusing on stimulating demand for those products, online retailers can put up a fight to stay in the black.

Connect your purchasing and marketing departments to ensure that marketers are only promoting the most profitable products. As the current situation calms down, improve this collaboration by connecting marketing and purchasing to the same source of data to prevent siloing. With purchasing working alongside marketing, your company will be able to not only stimulate the demand, but be assured that the demand can then be met.

COVID Profitability Checklist

- Know where your profit comes from. Which items are your bread & butter? What are your top five products in terms of overall profitability (including marketing expenses, return chance, and any additional factors)?

- Connect marketing to the data used by the rest of the organization so they can make data-driven promotion decisions

- Keep your ads running if you can. There may be less overall demand, but there are also fewer retailers competing for those eyeballs. Plus, you need to sell the inventory you have in order to have cash on hand

- Sell to new potential customers; the customers who wouldn’t be shopping on Facebook if it weren’t for COVID-19.

Stop promoting products that aren’t making money. A product that sells like hotcakes, but has a slim margin and numerous returns, may end up losing you money in the end.

The Next Step

Retailers who had fully mapped their supply chains before COVID-19 will weather this storm best. They are in better contact with suppliers, and can be informed of issues faster. They know which parts of their chain are vulnerable, and can plan ahead to avoid problems, rather than having to rush a solution when a problem becomes apparent.

Mapping the full supply chain is an involved and difficult process, which is why so few companies have done it. A company needs to know, not just their own suppliers, but their suppliers’ suppliers. And their suppliers’ suppliers’ suppliers. They should aim to map every tier, all the way down to the raw materials used.

Company alignment and communication is also key to improving capital efficiency. From the Harvard Business Review:

“People from procurement, logistics, and supply-chain financing need to come together to talk about what key gaps (tools, information, people, processes, etc.) need to be fixed to protect the company from disruptive events in the future and how to align the goals of procurement with the overall business objectives.”

harvard business review

The future belongs to the companies who understand their supply chain through-and-through, can align their departments around the same source of data, and know where their profits are coming from and which products perform best in each campaign.