Product Performance Management

Do you know which of your products are “good” for business, and which are “bad?” Can you focus your budget on the good products in real time?

Product performance management (PPM) is a new category making this possible, and it’s why 2.36% of global e-commerce is powered by ROI Hunter.

What’s stopping you from focusing on the right products?

To understand true performance, you must include marketing costs and more.

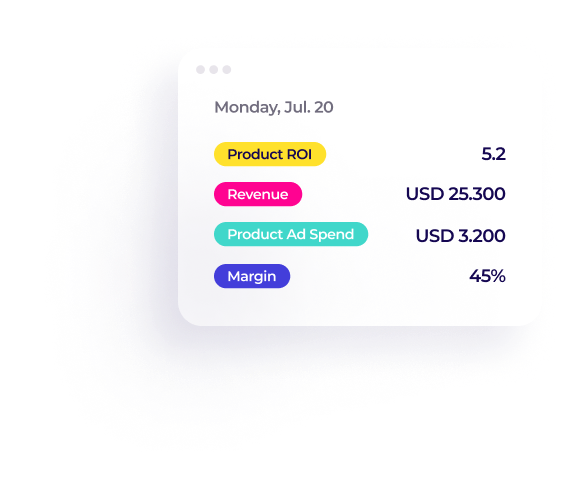

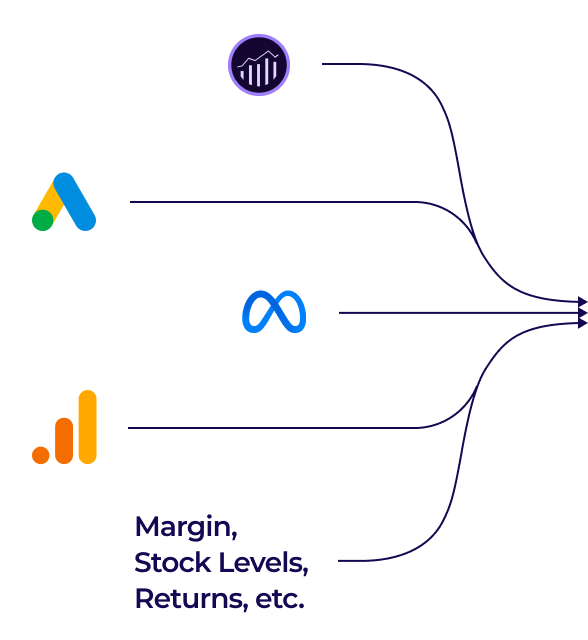

Deconstruct campaign performance down to the product level, and combine it with business metrics like margin, return rate, and ad spend to create a common data layer.

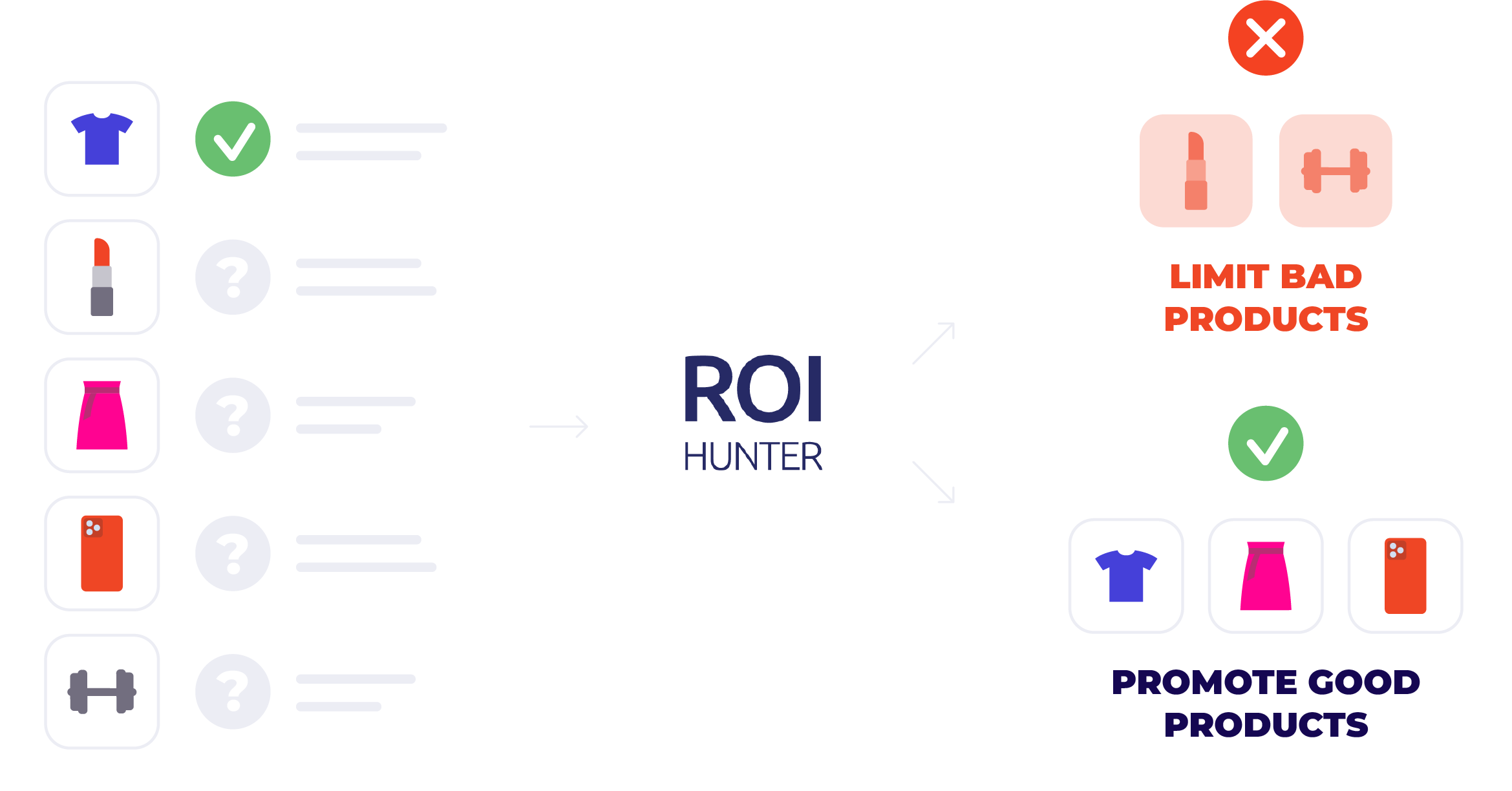

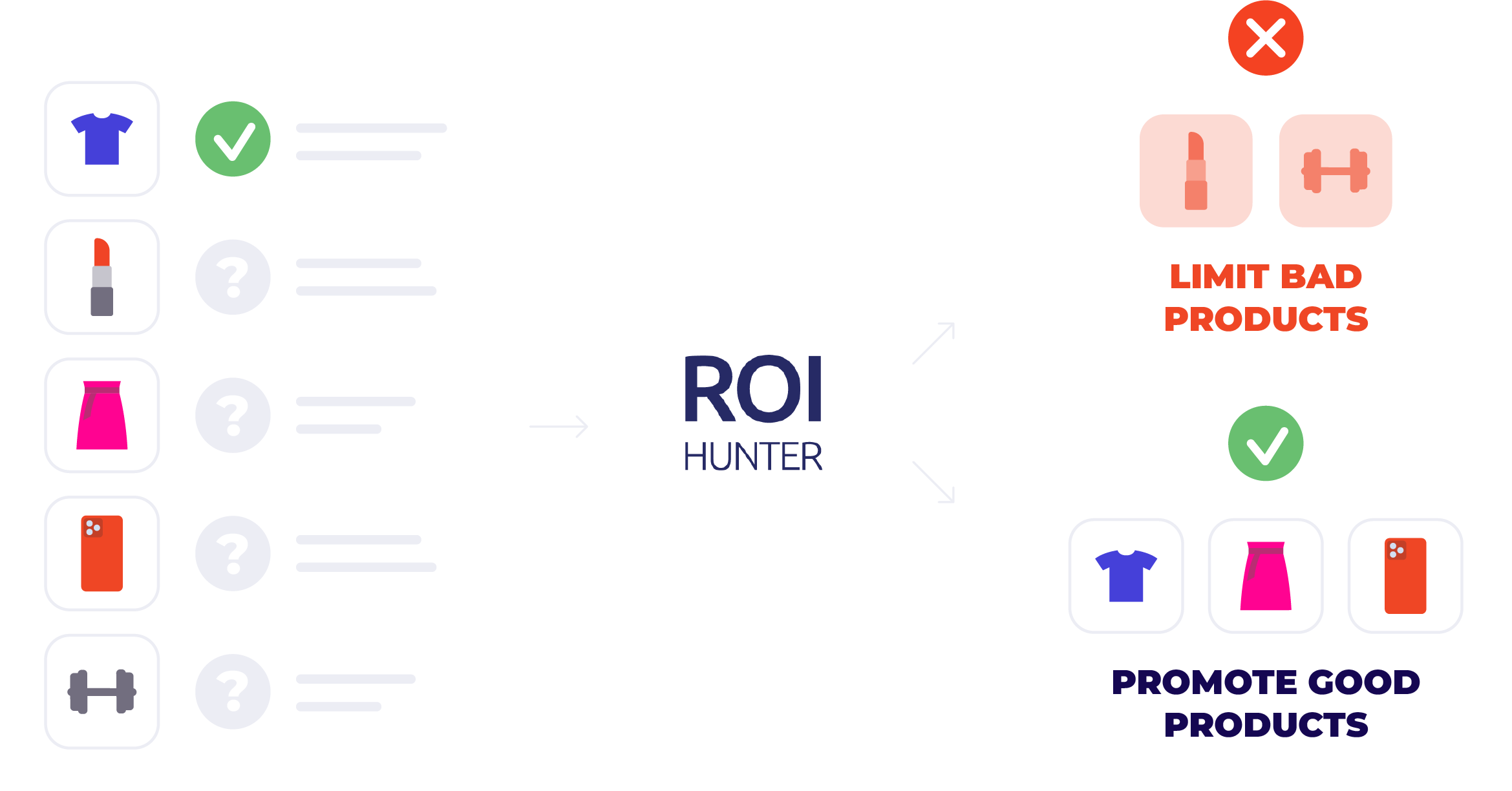

You can't control which products the ad platforms promote with their algorithms.

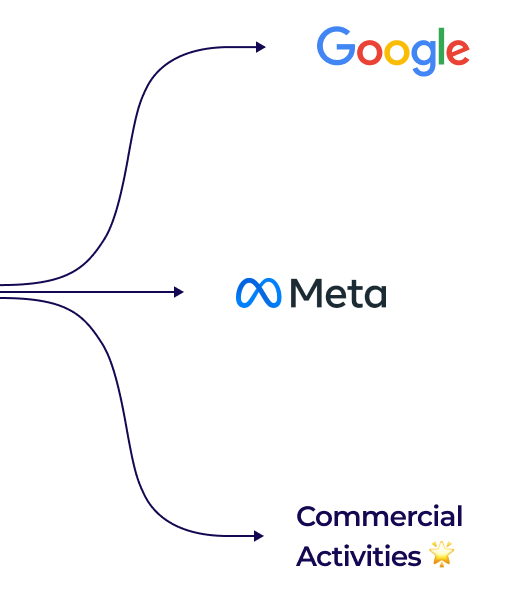

Help the ad networks recognise which products are right for your business priorities.

Focusing on the right products needs to be actionable in real time.

Update promotions automatically and in real-time to ensure the right products always have focus.

Deconstruct campaign performance down to the product level, and combine it with business metrics like margin, return rate, and ad spend to create a common data layer.

Help the ad networks recognise which products are right for your business priorities.

Update promotions automatically and in real-time to ensure the right products always have focus.

One Platform. Infinite Possibilities

Stop manually uploading SKUs or running messy segmentation campaigns to ensure your product promotions are profitable.

Imagine simply defining what profitable means to your business, and the right products automatically being promoted to achieve it.

Stop guessing what should be discounted or purchased based on sales data that lacks the context of the marketing efforts behind each SKU.

Imagine easily filtering to find the items with the highest transactions, the lowest marketing spend, and the fewest returns.

Stop applying the constant design changes that come with promotions, price shifts, and holiday themes.

Imagine creating a design template with conditional layers that automatically fills with pictures of the right product, price, and branding.

ROI Hunter at a glance

Connect

Execute

Connect

Execute

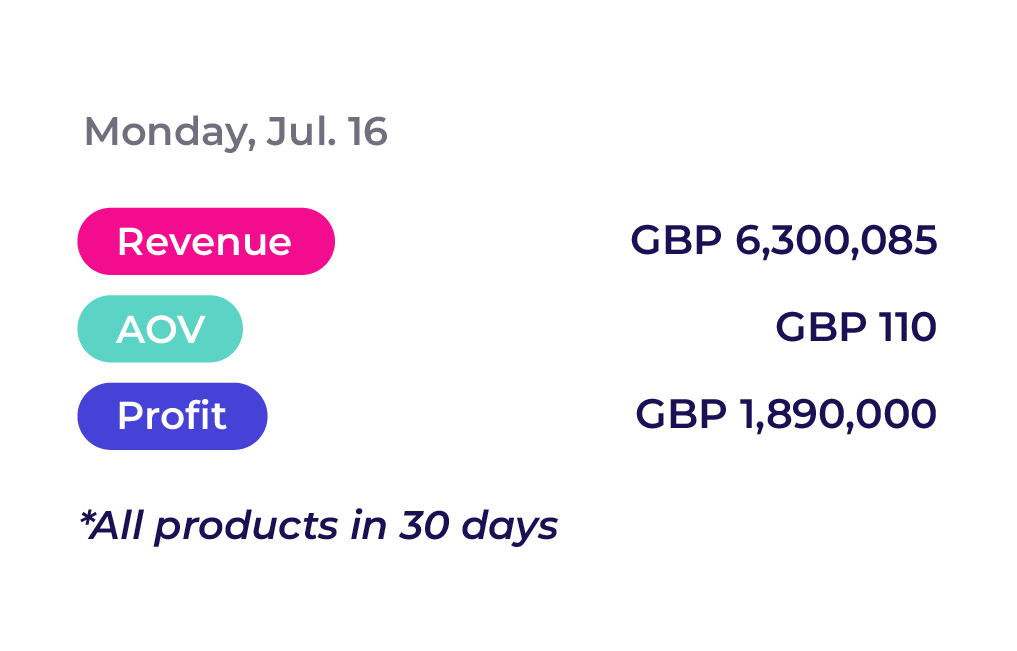

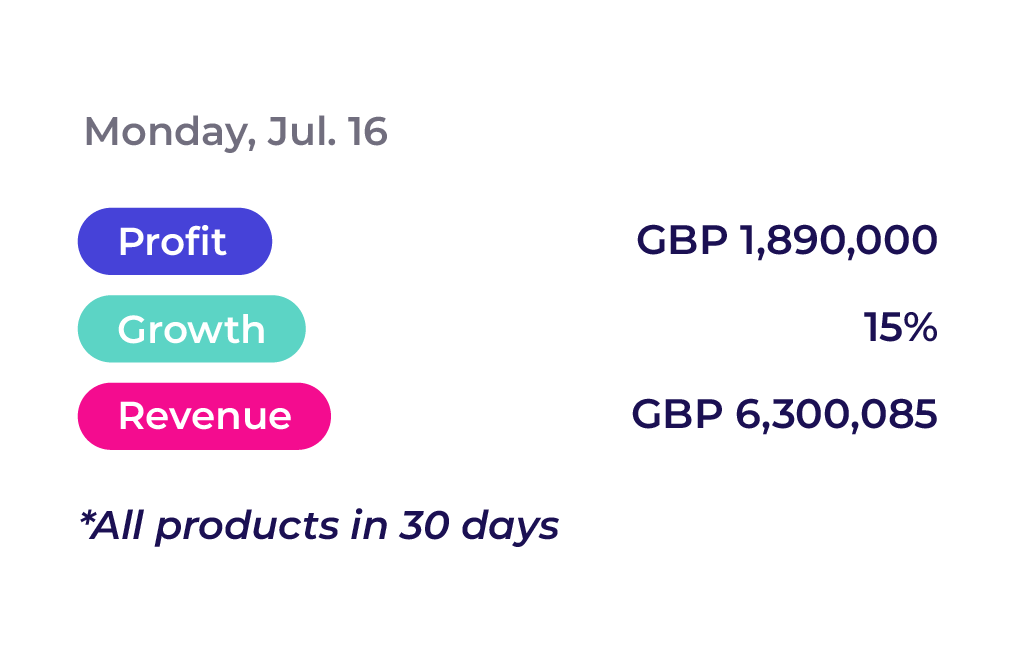

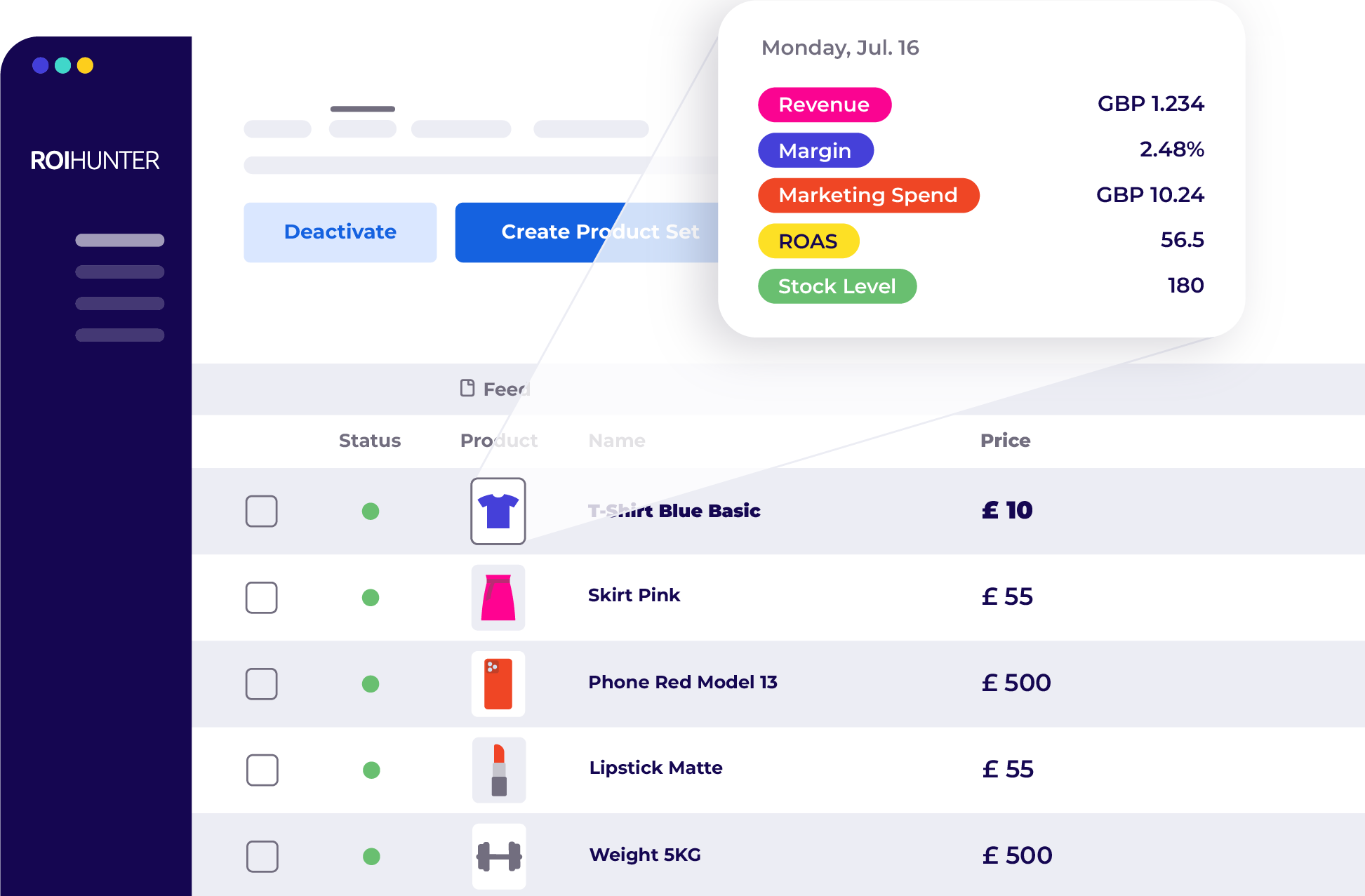

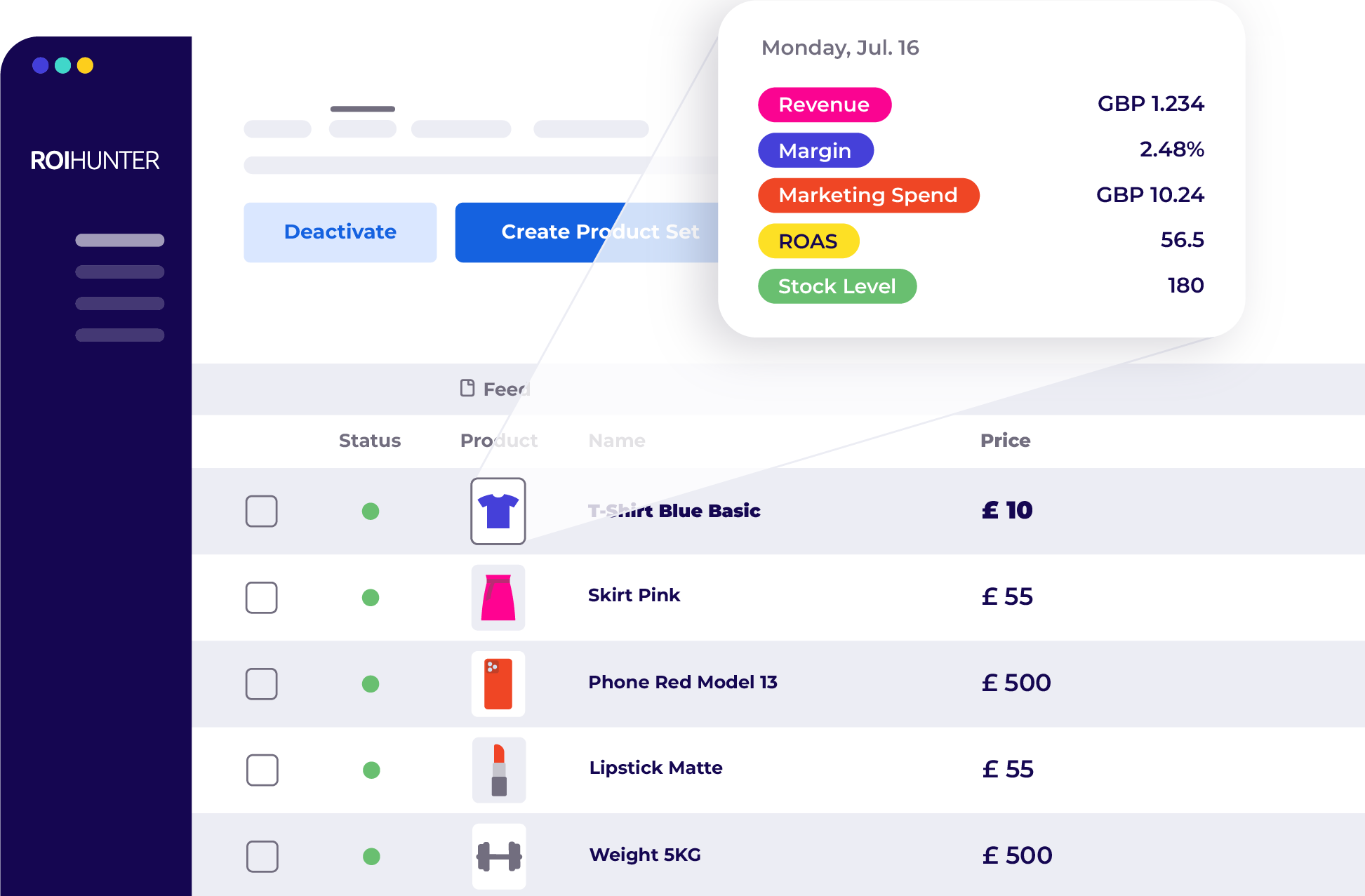

Review the performance of each individual product in your catalogue. Product performance data is collected from across your channels, analytics platforms, and custom sources, and combined with your catalogue to form a single source of truth.

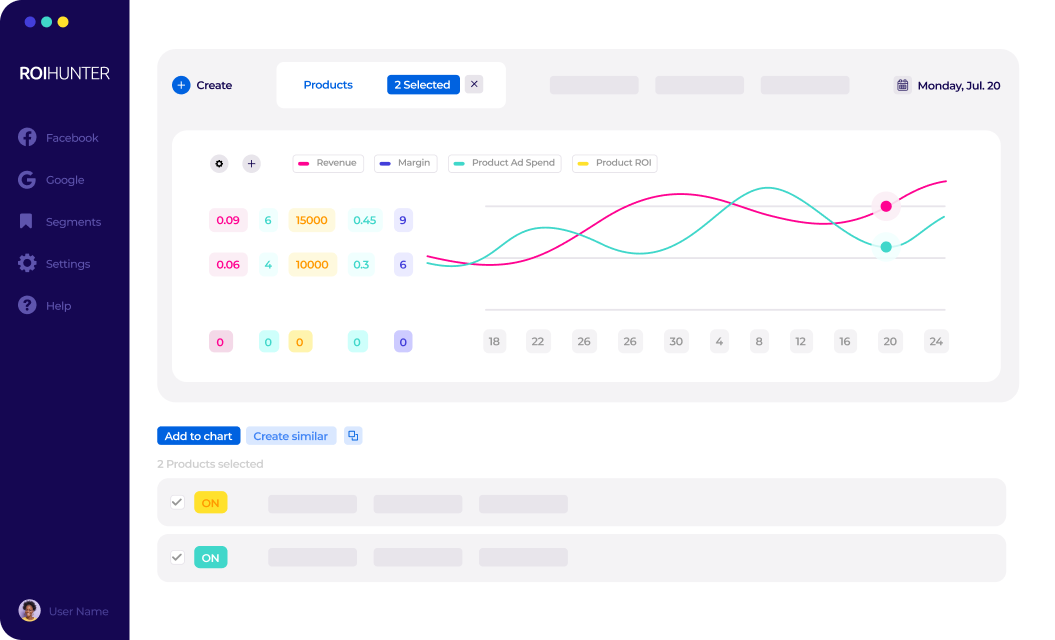

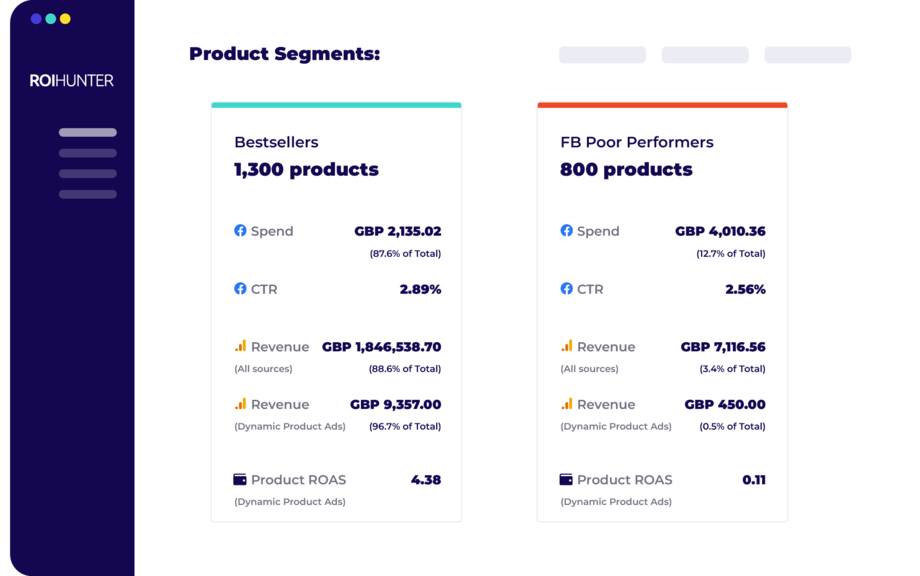

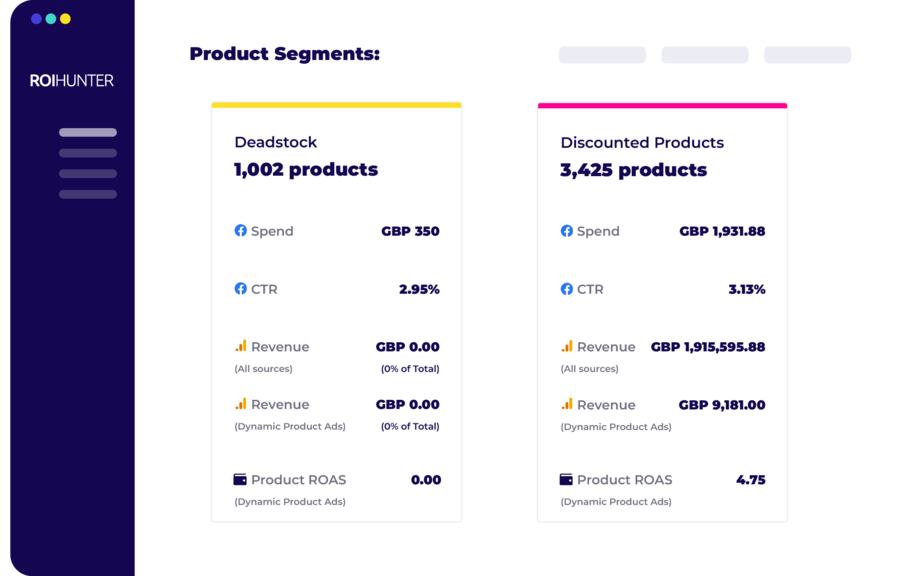

View and analyse groups of similar products (bestsellers, deadstock, poor-performers, new arrivals, fragmented stock, and more). Easily find which products are wasting your budget and which need more budget added, all in real time and on the same dashboard. Make instant changes to your campaigns based on what you see.

See your Meta campaign results, Google campaign results, and Google Analytics metrics all in the same place.

Analyse your product-level performance for each campaign. See which category and product performed the best and which took the biggest portion of your spend.

Create unique strategies based on your data and business priorities. Our customer success experts will help you define and execute the best strategies to reach your business goals.

Use the right products for every campaign. Filter your catalogue by any metric you can think of: ad-spend per product, revenue, Meta Spend, Google Shopping impressions, and more, and promote these custom groups on Meta and Google from the same platform.

Create Meta promotions without a graphic designer. Schedule promotions ahead of time, automate product badges, change your ads without a new review, and more.

Act in real time with automation rules for your Meta campaigns. Automate product badges, free shipping promotions, bestseller indicators, and more.

Turn your data into action with one user-friendly location for launching all your product campaigns on Meta and Google Performance Max.

Trusted by 300+ retail brands

around the world

“ROI Hunter's experience and product insights tool has allowed us to take our Google Shopping campaigns to the next level, providing substantial short and long-term growth.”

"Since adoption, we have seen marked improvements compared to our SMART Shopping campaigns.”

“Working with ROI Hunter could not have come at a better time for us. The business had seen strong, sustained growth across social and we were looking for a platform that would enable us to elevate our performance even further and take our campaigns to the next level.”

Who uses ROI Hunter

How much revenue are you losing by focusing your budget on the wrong products?

Up to 20% of the marketing budget spent on feed-based campaigns is wasted on products with negative ROI, damaging your overall performance. Fix it today.

How much time do you waste by manually creating ads, reporting, exporting results, and segmenting campaigns for greater control using multiple tools?

Start saving time. Create ads in seconds, add conditions for automation, scale them across multiple campaigns, and launch them, all within the same platform.

How can you know what to discount or set the best price for each product if you can’t see marketing spend behind it in real-time?

How can you make purchasing decisions if you don’t know the spend required to sell each product, and the revenue produced? Add product performance data to the equation, and you can discover if a product is lacking sales because the price is too high or if it simply wasn’t promoted.

How can you improve profitability if you don’t have control of the products you’re promoting?

The algorithms of platforms like Google or Meta promote discounted products as it produces “easier” revenue, while new arrivals don’t see promotion for an average of two weeks. Take control and increase profitability by promoting new arrivals and full price products instead.